A Better Way To Pay For Healthcare

As healthcare costs continue to soar, finding ways to offer affordable health benefits to your employees is a constant challenge. Now you can leave employees with more spending money per paycheck while they save money on out-of-pocket healthcare expenses with a Health Savings Account (HSA) solution from Streamline HR.

A Streamline HR HSA helps you:

- Add depth and flexibility to your employee health benefits and retirement plans with secure, FDIC-insured financial accounts.

- Reduce FICA and FUTA payroll taxes.

- Save money on health insurance premiums by offering HSA’s along with high deductible health plans (HDHPs).

- Provide web-based, fully integrated portals with 24/7/365 access to account information & HR services.

- Promote healthier lifestyle choices through increased employee involvement and use of 100% covered preventative care.

- Go Green with paperless online claims, direct deposit reimbursement, and electronic statements.

A Streamline HR HSA helps your employees:

- Offset rising healthcare costs with tax-free funds.

- Plan for future health expenses with tax-free investment accounts that grow year over year – no “use-it-or-lose-it: annual requirement.

- Easily monitor health spending with convenient debit cards and secure online account access.

- Plan for retirement – after age 65, participants can use HSA funds for non-qualifying expenses.

How HSAs Work

With a Streamline HR HSA, any earnings on your contributions are not subject to taxation. The HSA account is funded by pre-tax contributions by the employee.

Employers and other third parties can also contribute to the account. The employee determines the amount of money that is withheld each paycheck before payroll taxes are deducted. This gives employees more take-home pay, while you, their employer, pay less in FICA and FUTA payroll taxes.

When an employee incurs a qualified medical expense, they can pay using the Streamline HR prepaid benefits card or through online / paper distribution request. If the employee doesn’t have enough money in their HSA to cover a medical expense, they can make a partial payment and pay the difference using another method.

There is no “use it or lose it” condition. Any unused funds remain in the account and continue to accrue interest until used.

Powerful Employer Features

- Health FSA, HRA, HSA, dependent care, wellness and transportation accounts are fully integrated in one platform, along with custodial banking services.

- Automated scheduling of lump sum, first of the month, or payroll cycle contributions allows for easy mid-year enrollments.

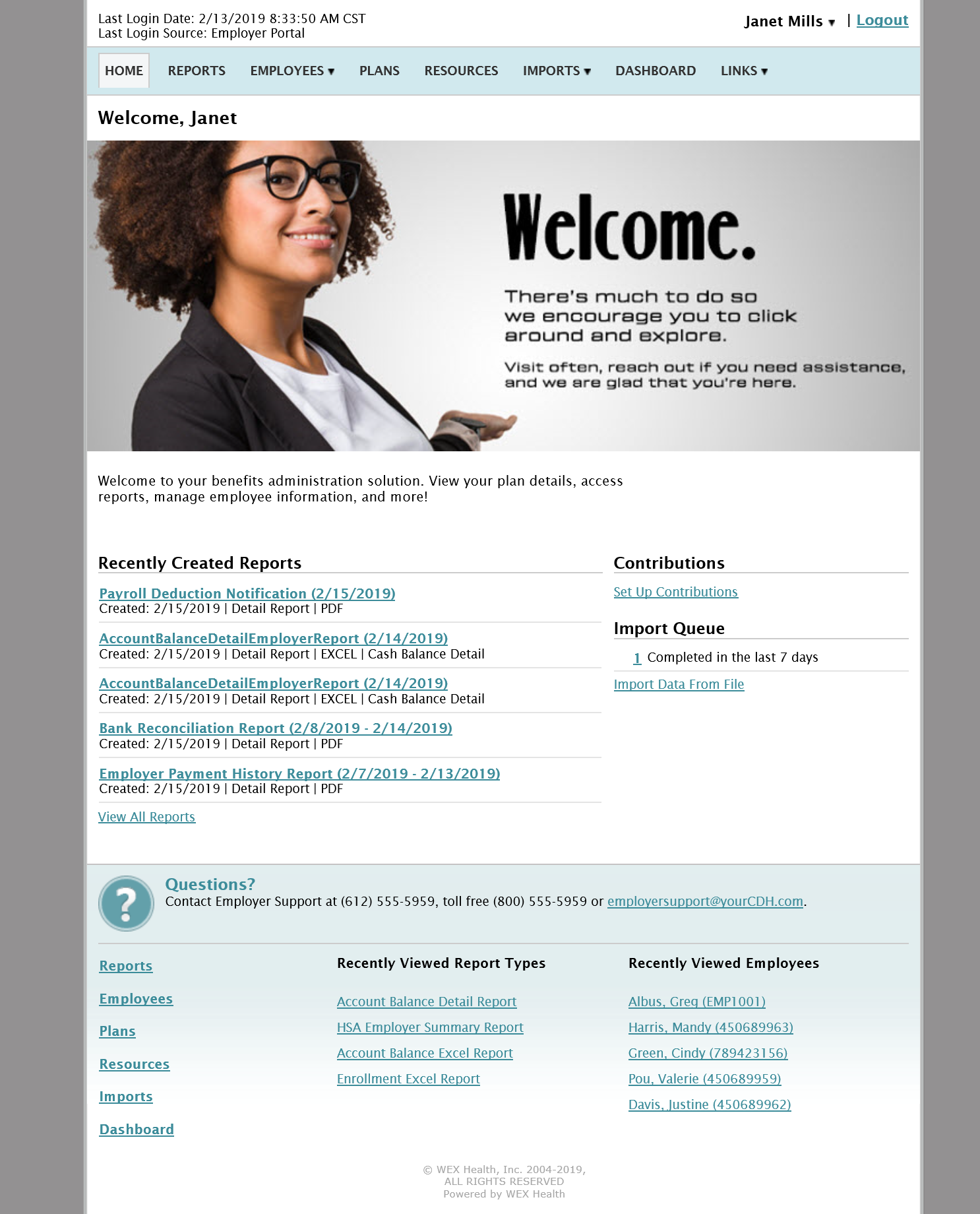

- Web-based, fully integrated portals provide 24/7/365 access to account information.

- Monthly reports generate automatically, with email alerts directing recipients to secure portals for viewing—creating a virtually paper-free administration process.

- Employees can access funds through online distribution requests, or by using a convenient benefits debit card.

- An integrated prepaid debit card provides seamless, flexible fund access and compliance.

- Distributions can be sent to employees by direct deposit or check.

- Employees can view account details, request distributions, update addresses, change payroll deduction elections, view statements, change beneficiaries, or allocate funds into an array of mutual funds using convenient online portals.

- Automated communication and email alerts ensure consistent messaging.

- FDIC-insured cash and interest-bearing account.